A new policy on subsidies for multinational corporations in Shanghai came into effect on February 1, and will run through January 31, 2029.

Earlier this month, Shanghai released a work plan to enhance its business environment, with 150 initiatives aimed at attracting foreign investments and enterprises.

The newly announced subsidy policy is part of the drive to encourage more MNCs to set up regional headquarters and research and development centers in Shanghai, boost foreign-invested businesses and improve the quality of foreign investments.

MNCs that intend to establish or have already had regional headquarters and R&D centers in Shanghai can receive considerable funds, with financial support provided by both the district government (60 percent) and the city government (40 percent). Additionally, the district government will provide rental subsidies for qualified MNCs.

Application requirements

1. Companies established in Shanghai must have operated legally and continuously for over one year, and have sufficient economic and social benefits.

2. The companies must have commendable financial and tax credits and sound financial management structure. They must not be listed by any level of government as dishonest debtors, and there should be no history of defaults on the city's public credit information platform within the past 3 years.

3. Companies must submit foreign-invested enterprise information reports as required.

Applicants are prohibited from repeatedly applying for financial assistance for the same matter. Be responsible for the authenticity, accuracy and completeness of the application materials.

Subsidy standards

Business establishment subsidies

1. To qualify for a 5-million-yuan (about US$695,000) subsidy, the companies must meet the following criteria:

- Have a paid-up registered capital of no less than US$30 million;

- No less than 10 employees;

- Recognized as MNC regional headquarters or divisional headquarters in Shanghai after November 1, 2022;

- Authorized by the parent enterprise to manage at least one domestic or foreign enterprise.

2. To qualify for a 5-million-yuan subsidy, the R&D centers must meet the following criteria:

- No less than 50 full-time research and development personnel;

- Recognized as global research and development center in Shanghai after December 1, 2020;

3. The establishment subsidy will be provided over 3 years based on the ratio of 4:3:3.

4. Note that is that all the MNCs should submit the application materials within three years of being recognized as a MNC regional headquarters or global research and development center.

Rental subsidies

1. Requirements to get a three-year subsidy based on 30 percent of the rent:

- Paid-up registered capital should be no less than US$2 million;

- No less than 10 employees;

- Recognized as the MNC regional headquarters or divisional headquarters in Shanghai after November 1, 2022;

- Authorized by the parent enterprise to manage at least one domestic or foreign enterprise;

- No more than 1,000-square-meter office space (excluding ancillary facilities and supporting rooms), with a maximum daily rent of 8 yuan per square meter;

- For the purchase or construction of self-used office space (excluding ancillary facilities and supporting rooms), a one-off funding subsidy will be provided based on the total three-year amount of the rental subsidy.

2. For global R&D centers recognized in Shanghai after December 1, 2020, with no fewer than 50 full-time R&D personnel, a rental subsidy can be enjoyed according to the same standards.

3. Enterprises should submit rental subsidy applications within three years of being recognized as regional headquarters, divisional headquarters, or global R&D centers.

4. During the subsidy period, self-used office space shall not be leased or sublet, and the purpose of the office space shall not be altered. Violations of the above provisions shall require the return of the received subsidy.

High-level rewards

Criteria of a 3-million-yuan reward:

- Paid-up registered capital of no less than US$2 million;

- No less than 50 employees;

- Designated as the regional headquarters or divisional headquarters for the Asia-Pacific region or a larger geographic area in Shanghai;

- Directors or key senior management personnel appointed by the parent enterprise are based in Shanghai.

Operational rewards

1. MNCs with regional headquarters in Shanghai, with a paid-up registered capital of no less than US$2 million, and an annual revenue of 500 million yuan or more:

- For the portion of annual revenue reaching 500 million yuan but less than 1 billion yuan, a one-off reward of 5 million yuan will be given;

- For the portion of annual revenue reaching 1 billion yuan but less than 1.5 billion yuan, a one-off reward of 3 million yuan will be given;

- For the portion of annual revenue reaching or exceeding 1.5 billion yuan, a one-off reward of 2 million yuan will be given.

2. MNCs with divisional headquarters in Shanghai, with a paid-up registered capital of no less than US$2 million and an annual revenue of 1 billion yuan or more:

- For the portion of annual revenue reaching 1 billion yuan but less than 1.5 billion yuan, a one-off reward of 5 million yuan will be granted;

- For the portion of annual revenue reaching 1.5 billion yuan but less than 2 billion yuan, a one-off reward of 3 million yuan will be granted;

- For the portion of annual revenue reaching or exceeding 2 billion yuan, a one-off reward of 2 million yuan will be granted.

3. The reward will be provided over three years based on the ratio of 4:3:3. Companies are required to submit an application in the year following the achievement of the operational reward criteria.

Capital-increase rewards

1. A one-off reward of 2 million yuan will be given:

- MNCs regional headquarters or divisional headquarters investing in foreign-funded projects that align with Shanghai's industrial development orientation (excluding real estate, finance, and projects similar to financial industry);

- The annual increment of actual foreign investment amount should not be less than US$30 million;

- The capital increase reward corresponds to the amount of increased capital, which should be calculated based on the actual foreign investment amount included in the annual statistics of the Ministry of Commerce. The applicant unit must commit in writing not to reduce, withdraw or convert domestic capital within three years;

- The amount of capital increase corresponding to the capital increase incentive shall be calculated based on the amount included in the actual foreign investment statistics of the Ministry of Commerce;

- The applicant shall make a written commitment not to reduce, withdraw, or switch to domestic investment within three years.

2. Only one capital increase reward can be enjoyed during the implementation period.

3. The amount of capital increase corresponding to the capital increase incentive shall be calculated based on the amount included in the actual foreign investment statistics of the Ministry of Commerce. The applicant shall make a written commitment not to reduce, withdraw, or switch to domestic investment within three years.

4. Enterprises should hand in the application material after the year of the amount of capital increase. Applications for both capital increase reward and establishment subsidies are not allowed within the same year.

Application and review process

1. The Shanghai Commission of Commence will publish the notification of headquarters capital application and clarify the application requirements.

2. All qualified MNCs can apply and provide the required application materials.

3. The commission will entrust a third-party institution to process the materials. The commission will then re-examine the materials based on the results of the third-party institution and Shanghai's bureau of finance to make the final decision.

4. The commission, in collaboration with the bureau of finance, will inform the commerce authorities and finance departments of enterprises regarding the audit outcome.

Q: Hello, I'm planning to engage in commercial and trading activities in East China's Shanghai. What preparations should I make?

A: To participate in business activities, you should apply for an M, or business visa.

01 How to apply

You can apply for the visa online at the Chinese Visa Application Service Center. The visa center's websites provide online form completions and visa application status query services.

[Long press the QR code to the visa center]

02 Documents required

☑️ Original passport valid for at least 6 months

☑️ Visa application form, completed online and signed by hand

☑️ Color passport photo taken within 6 months

☑️ Documents concerning commercial activities issued by a trading partner in China, or trade fair invitation, etc.

[Long press the QR code to see checklist for M-visa application]

03 How to extend your visa

If you are in Shanghai and want to extend your business visa, you can submit an application to the Exit-Entry Administration of the Shanghai Municipal Public Security Bureau.

📍 Address: No 1500 Minsheng Road, Pudong New Area

🕘 Open: Monday to Saturday, 9:00 am - 5:00 pmIf you need any assistance with your visa application, please contact us

8621 - 51785021

info@jkinvest.net

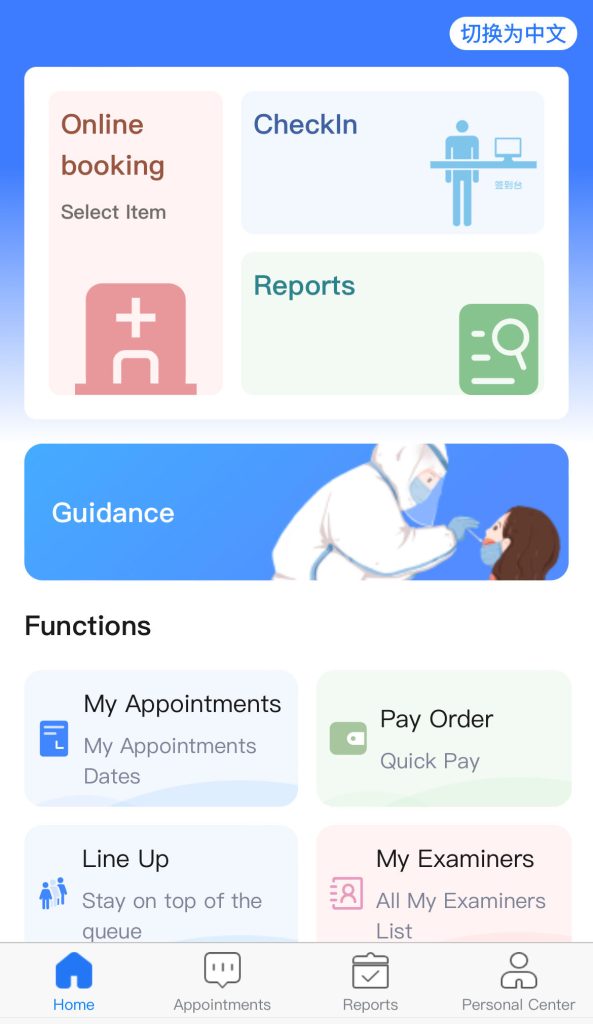

News from the "Shanghai International Travel Healthcare Center", the reservation of physical examinations (inculding physical examination for China work permit and residence permit) and vaccinations will change from website to the WeChat reservation platform since January 15th 2024. The original web version of the reservation platform will no longer be open for reservations since then. Please search for the WeChat public account “Shanghai International Travel Healthcare Center上海国际旅行卫生保健中心” and click the “online booking” button in the menu or use WeChat to scan the QR code below:

The State Council has approved a general plan for advancing the institutional opening- up of the China (Shanghai) Pilot Free Trade Zone in alignment with high-standard international economic and trade rules, according to a circular issued last week.

This is the latest move of the Chinese government to promote the high-standard opening- up of the country.

The opening-up measures the Shanghai FTZ is encouraged to pilot this time cover almost all bottleneck issues related to the service trade, including data transfer and cross-border capital management, which are crucial to the high-quality growth of the Chinese economy and the country's further integration into the global system.

Under the framework of a national security management system for cross-border data transfer, financial institutions in the zone will be allowed to transfer data necessary for daily operations overseas.

The zone is required to build data sharing mechanisms to encourage businesses to share data, promoting the innovative application of big data. The zone will also promote cooperation between overseas and domestic institutions, in order to build a digital economy exchange platform for small and medium-sized enterprises.

The zone is expected to refine policies for multinational companies to operate and manage cross-border capital, and support the companies to set up capital management centers. The free trade account system will be improved to ensure the free flow of capital between the Shanghai FTZ and overseas regions.

Notably, the circular stresses that relevant overseas parties can participate on an equal footing in the revision process for the laws and regulations in the Shanghai FTZ.

These measures to open China's service industry represent an important step to align its domestic rules with global conventions by calibrating regulations, management and standards. If these measures can realize their intended effects, they will help effectively strengthen the connection between China and the world market in a move to counter some developed countries' "decoupling" practices targeting China.

The circular provides the Shanghai FTZ with broad space to explore new paths and accumulate new experience for comprehensively deepening reform and expanding opening-up nationwide. The zone is expected to make full use of it to fulfill its duties and hence further consolidate its status as a major growth engine and a trailblazer on the path of high-quality development.

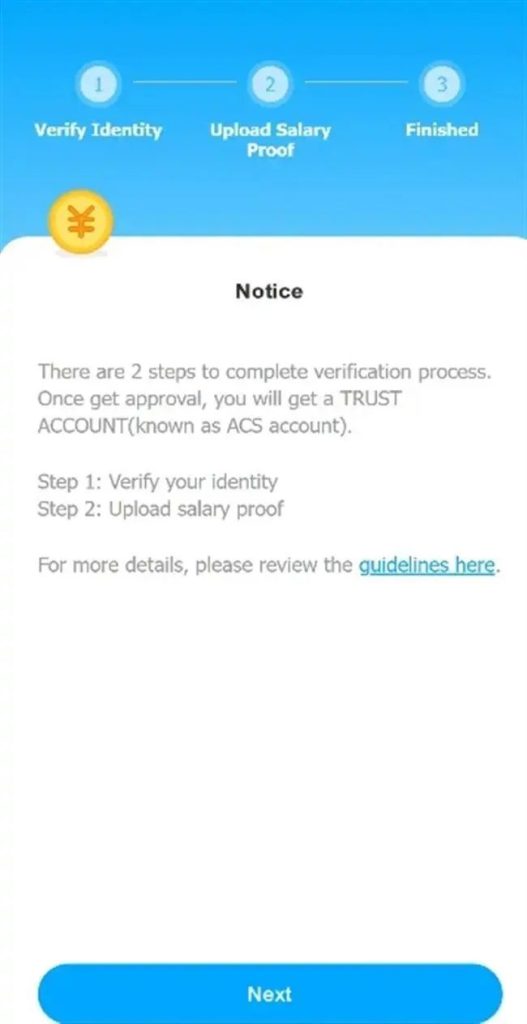

SkyRemit is an income remittance product designed specifically for foreigners in China to transfer money to their overseas accounts. Both the Hong Kong Customs and Excise Department and the People's Bank of China regulate it.

SkyRemit has a full English user interface, 24/7 customer service, quick processing time, and lower costs compared with traditional banking services.

SkyRemit also offers users real-time, favorable exchange rates 24 hours a day, seven days a week, making it a time-efficient, cost-effective, and hassle-free alternative.

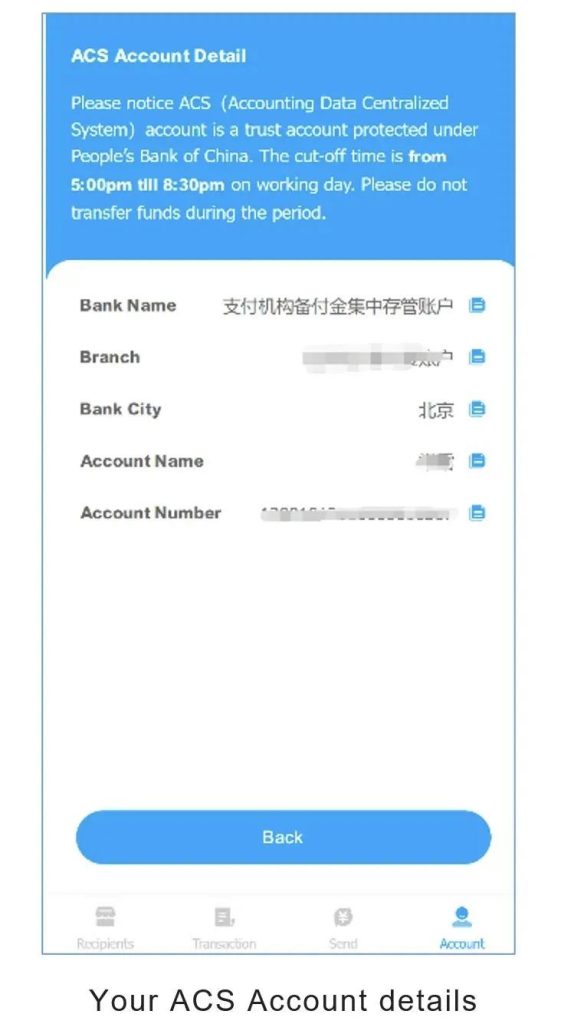

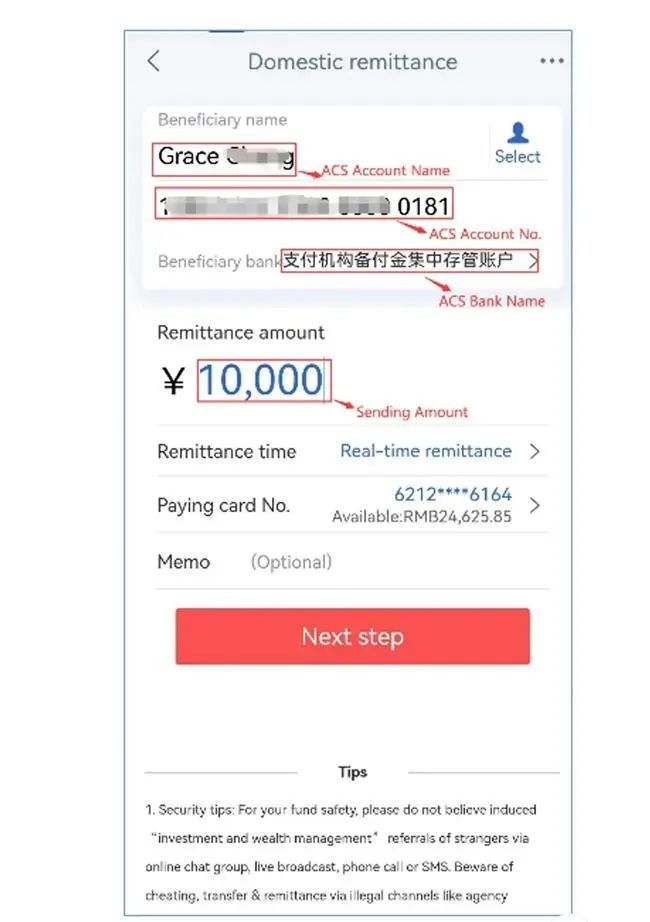

Step 1: Scan the QR code to sign up and open a trust account (known as ACS account).

Step 2: Transfer yuan from your China bank account to the trust account.

Step 3: Once the foreign exchange rate is confirmed, funds are transferred into your overseas accounts.

Note:

The minimum amount per transaction is 500 yuan, while the maximum is 100,000 yuan.

“

Please accept this recommendation for Lillian Zhou and the entire staff at J&K Investment Consulting (Shanghai) Co. , Ltd.

My Company The Charles Boggini Company from Coventry Connecticut USA engaged Lillian to assist in the set up of a trading company in Shanghai China also know as a WOFE . From the first meeting with Lillian I felt comfortable that J&K could handle all the details needed to complete the job.

The entire process was handled in a professional manner and the communication was very clear. Lillian and her staff were able to translate and explain clearly the details all the way thru the process. I was so comfortable with the WOFE setup that I continued with Lillian and J & K to mange my accounting and company details for the past two full year.

The staff is very efficient and detail oriented. I would be happy to refer them to any prospective client.

David C. Boggini

Founder & CEO, Boggini Trading (Shanghai) Co., Ltd

“

We have been cooperating with J & K in the past 6 years and we highly appreciated their visa services for our foreign employees. The number of our foreign employees is big and they work for our Shanghai head office and branches in different cities in China, to

control the employment and visa risk is not quite easy. Fortunately,we found J & K , they are our trustworthy visa consultant, their professional acknowledges and working schedule make us have no doubts and troubles when we are facing the employment and visa issues, no matter application, modification, extension and termination. We highly appreciated their efforts and hope to continue to cooperate and recommend J & K to you.

Vicky Zhou

C&B Manager, ASC Fine Wines

“

We have cooperated with J&K for many years, we deeply felt the professional services of them. When dealing with more complicated work, they always give quick feedback and provide effective solutions. J&K staff are very patient, meticulous and trustworthy. -- Lily Fang, Legal Department of WeWorkJ&K has participated in many company registration and change projects of us. For many years, they have been holding a professional and meticulous working attitude and provided us with extremely satisfactory services. J&K not only excellently completed various project tasks, but also provided us with solutions through their senior experience and knowledge to solve our problems and become an indispensable right-hand assistant in our work. Over the years, J&K and Wework have experienced growth and development together, they help their customers stay invincible in the changeable market competition. I believe that in the future, J&K will be able to serve more and better customers with unlimited future. -- Nancy Hong, Treasury Analyst of WeWork

“

What I admire most about the J & K team is their attitude towards service details. Each of them is striving for perfection. The J & K team has professional background and many years of experience, providing us with extremely satisfactory and pleasant service. Communication is the most important problem in the service, Every time J & K confirms and explains all problems in the work carefully and patiently, even the smallest details they try to ensure that there is no error. J & K not only provides us with high-quality services, but also provides many effective and feasible suggestions and guidance. J & K won the praise of our company, each of us is very willing to recommend such an excellent team to every potential customer.

Jane Hu

Centre Manager, ARCC Spaces

Leave us a message

Interested to Know More?

Please complete the form beside and we will get in touch with you soon!

Content with an asterisk (*) is required.